blog

Key Takeaways from the CCD Retail Update, July 2023

With a unique mixture of office buildings, education and health care institutions, cultural centers, single- and multi-family residences, retailers, restaurants, and service providers, Center City Philadelphia is one of the most diversified downtowns in North America.

These factors work together to sustain and enhance the vibrancy of downtown, as illustrated through this month’s Retail Update. This report highlights several of the most important developments in the Center City retail and restaurant scene, including new and anticipated openings, retail occupancy, and more. Check out four key takeaways below, and be sure to read the 15-page report for the full story.

More People Moving Downtown

Since 2010, the population in core Center City has increased by 31.5% to over 75,000. This continuous growth has attributed to the continuous expansions in residential units, as noted in this year’s Greater Center City Housing Trends report. Beyond just residents, foot traffic in Center City is also made of the region’s highest concentration of workers and visitors—including tourists and convention attendees. Philadelphia continues to be highly accessible by all travelers due to the numerous bus routes, regional rail lines, and subway lines that run through Center City.

Overall, downtown daily foot traffic has rebounded to 75% of 2019 levels, and up to 90% on the weekend. All of this foot traffic helps support the 1,871 retail storefronts within the Center City District.

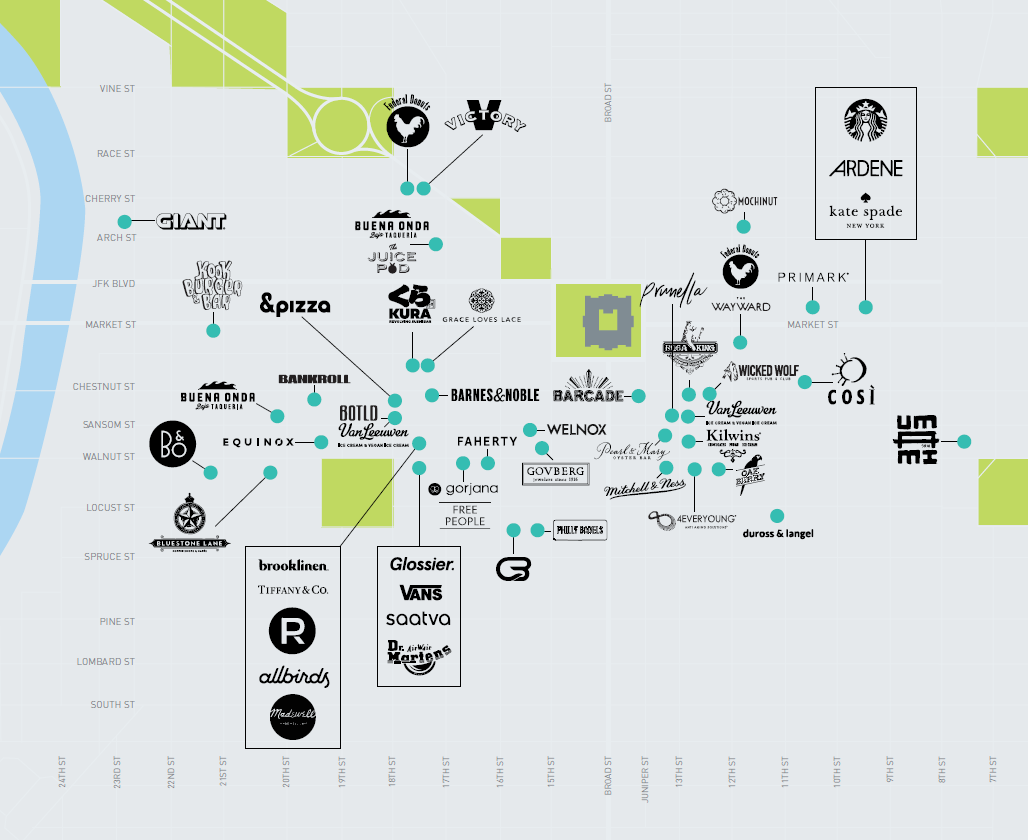

1,871 Storefronts in the Center City District

Within the District, there is a highly diverse mixture of retailers, restaurants, and service providers. The past several months have brought 70 new openings, with at least twenty-five more publicly announced within the next year. Of the District’s 1,871 storefronts, only 18% remain vacant, down from 45% in June 2020 and on-track to reach pre-COVID numbers of 11%. 29% of the total storefronts are restaurants, 28% are retailers, and 25% are service providers.

Among recent news, the Concourse at Comcast Center is home to several of the new openings, likely in part to their revitalized return to office measures. These openings include Buena Onda, The Juice Pod, Pizzeria Salvy, Focacceria by Di Bruno Bros, and Shaq’s Big Chicken. Other new restaurants and retailers appeal to the office district workforce include sushi automat Kura Sushi (1721 Chestnut Street), Latin American rum bar Bolo (2025 Sansom Street), and sports bar Kook Burger & Bar (2102 Market Street).

Outdoor Dining Continues to Grow

Despite the return of indoor dining, one area of continued growth in the District is sidewalk café seating. Just from 2022 to 2023, there’s been an almost 14% increase in the number of café style seating across the district, indicating that visitors continue to drive demand for outdoor seating and feel safe doing so. Since 2019, the total number of outdoor seats at streeteries and cafés have increased to over 4,800.

As noted in our 2023 State of Center City report, outdoor dining has been present in the District for more than 25 years. This has benefited both restaurants and pedestrians, especially in the peak of the pandemic, where it served as a lifeline for many businesses, and allowed pedestrians a safer way to meet during isolating times.

Sales and Tax Revenues Rebound

Thanks to the gradual return of workers, tourists, and residents, taxable retail sales during the first quarter of 2023 rebounded to 94% of 2019 levels within district boundaries, while bars and restaurants returned to 97% of 2019 levels. Additionally, bar, restaurant, and retail revenue in extended Center City have surpassed 2019 levels, likely since work from home activity has created a sustained daily demand.

Read the Full Report

Interested in seeing the full picture? Download the full 15-page report, Center City Retail Update, July 2023, today.

If you’re interested in learning more about Center City as a whole, check out our full reports section, featuring recent insights around pedestrian vitality and economic recovery.